Supporting Reed’s future

The Reed College endowment provides critical financial support to our institution. Annual distributions from the endowment meaningfully contribute to areas such as financial aid, student life, faculty retention, facilities, and long-term strategic planning.

The investment office and investment committee remain mindful of the significant role that the endowment plays in the strength and success of Reed College, both for today’s Reedies and for future generations. As such, the prudent and thoughtful stewardship of this vital and growing asset is our core focus.

Endowment Impact

- 32% annual contribution to the operating budget

- $284 million total provided to the college over the last 10 years

- $12 million provided for financial aid in 2025

Assets & Performance

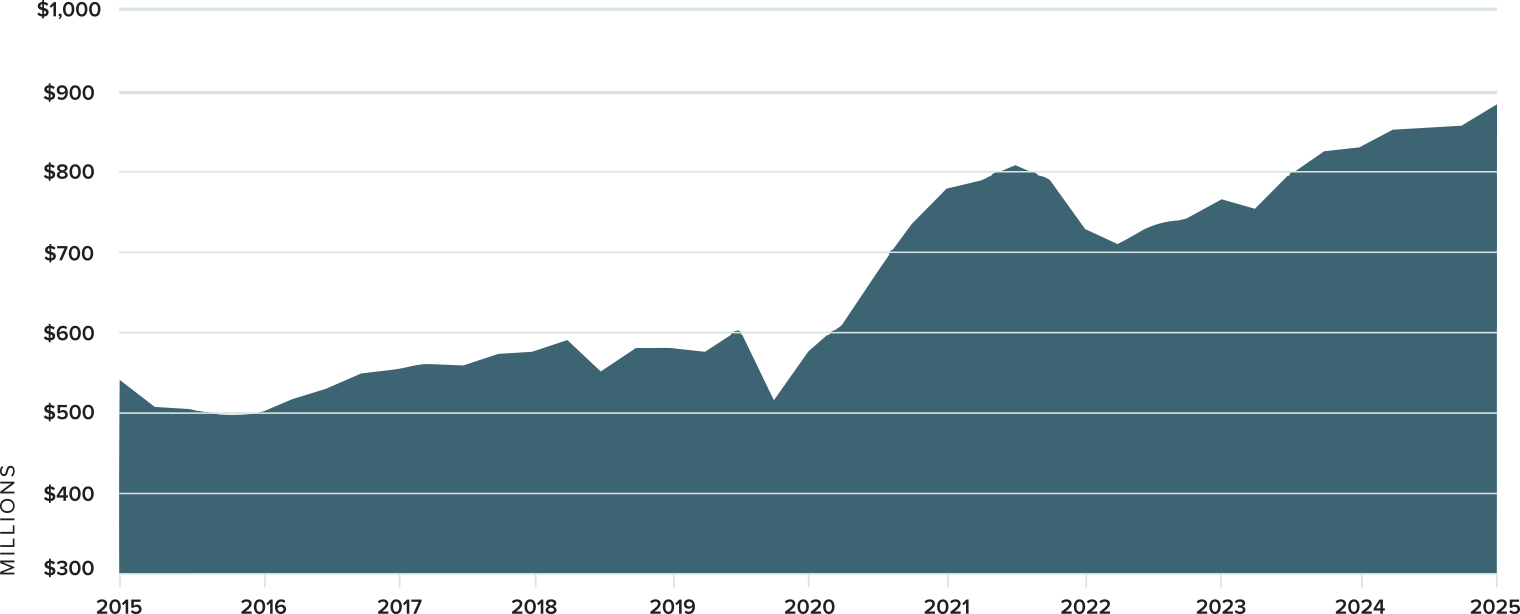

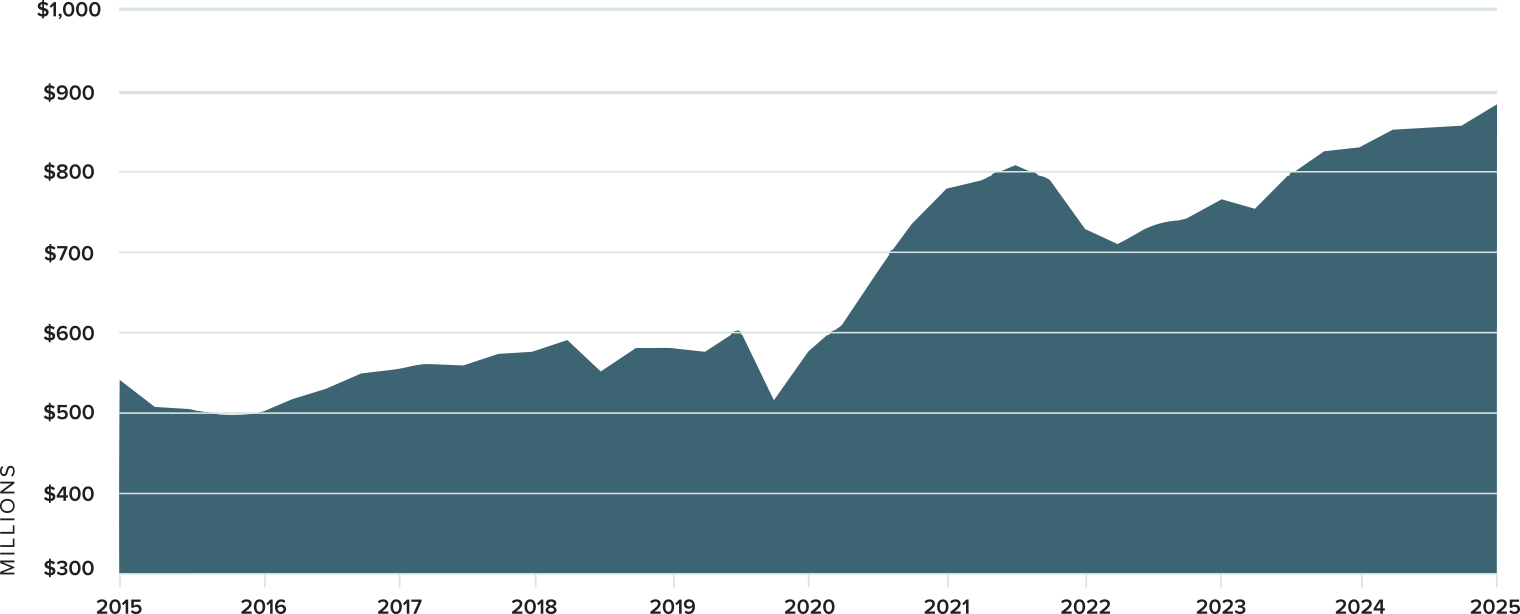

Over the last decade, the endowment has grown from $542 million to $885 million. The change in total value from year to year results from the return on investments, gifts received from donors, and the endowment spending payout.

Endowment Value Over Time (as of June 30, 2025)

To learn more about the endowment's asset allocation and long-term performance, view the annual endowment reports.

View Annual Reports

Governance

Who has oversight over the endowment? Learn how the Reed College Board of Trustees, the investment commitee, and investment office work together to support the college's mission.

Governance and Investment Policies

Frequently Asked Questions

What is the purpose of the endowment at Reed?

The endowment provides a long-term, reliable funding source for the current and future needs of the college. Without the financial support it provides each year to the operating budget, Reed would be far more restricted in realizing its central commitment: to provide a balanced, comprehensive education in liberal arts and science, fulfilling the highest standards of excellence.

How is the endowment invested?

The endowment is a globally diversified portfolio that invests across the spectrum of assets, both public and private, within the capital markets. Because the endowment is a perpetual asset, we are long-term investors with the goal of prudently growing the principal while ensuring the current spending needs of the college are met. When putting endowment assets to work, we invest via commingled funds (alongside numerous other institutional clients) that are managed by external asset managers. These external asset managers exercise independent discretion over the investment strategy and underlying assets within their funds. We do not invest in individual securities. In terms of separately managed accounts (a.k.a. funds of one), these are only suitable for larger pools of assets such as state pension plans or sovereign wealth funds due to high investment minimums and thus are not applicable to an institution of Reed’s size.

Are tuition dollars invested in the endowment?

No. All tuition dollars, room, board, and other fees paid by students and their families are used directly to support the annual operating needs of the college.

What is the current spending policy of the endowment?

The current spending policy is 5% of a trailing 13-quarter average market value of the endowment. We use a trailing average to smooth out the variability of year-over-year endowment returns which allows for a more predictable and stable cash flow to the college. The spending policy is determined annually by the trustees as part of the budget process.

Are there any restrictions on the endowment payout?

The endowment comprises thousands of individuals gifts donated to the college over decades. These gifts are designated as “unrestricted” or “restricted.” Unrestricted gifts go into the general endowment pool and allow the college to direct the funds to the areas of greatest need. Designated gifts have specific purposes attached to them (e.g., a faculty chair or an academic program) and carry legal binding obligations that guide how their investment returns may be spent.

What is UPMIFA and how does it impact the management of the endowment?

UPMIFA stands for Uniform Prudent Management of Institutional Funds Act and establishes standards governing how endowments are invested. Essentially, this requires institutions to act as fiduciaries—an obligation to focus on prudence, loyalty, and care when managing a pool of assets. The state of Oregon adopted UPMIFA in 2007.

Contact Us

Investment Office

Reed College

3203 SE Woodstock Blvd

Portland, Oregon 97202

Email: investments@reed.edu