Monetary and Fiscal Policy

Fall 2012

Jeffrey Parker, Reed College

Final Essay, Due: 9am, Wednesday, December 12

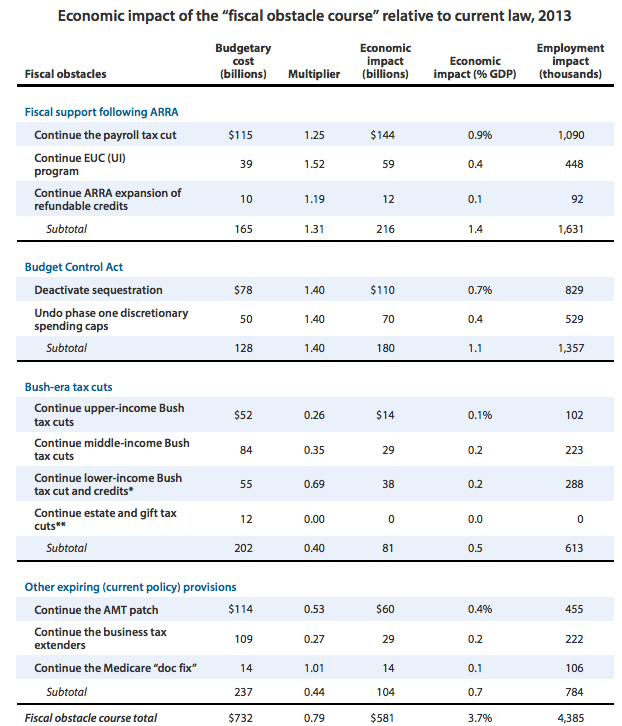

A recent Washington Post article (sent to the class by one of your classmates) contains the following table estimating the economic effects of the "fiscal cliff":

Based on the table, answer the following questions:

- Explain how the columns of the table relate to one another. How do the multipliers work? What assumptions are necessary to move from the left column to the right ones?

- Why are some multipliers larger than others? Are the differences consistent with economic theory?

- Consider the multipliers for the following three items: (a) payroll tax cuts, (b) middle-income tax cuts, and (c) sequestration spending. Based on the range of estimates we examined in the papers we read for class, are these assumed multipliers small, large, or in between?

- These estimates are for 2013. Based on what we (think we) know about the timing of fiscal impacts, what, if any, effects might lie beyond 2013?