In the Media

March 29, 2024

Beyond Sound, Beyond Limits

Assistant professor of music Bora Yoon was highlighted in an artist feature.

March 29, 2024

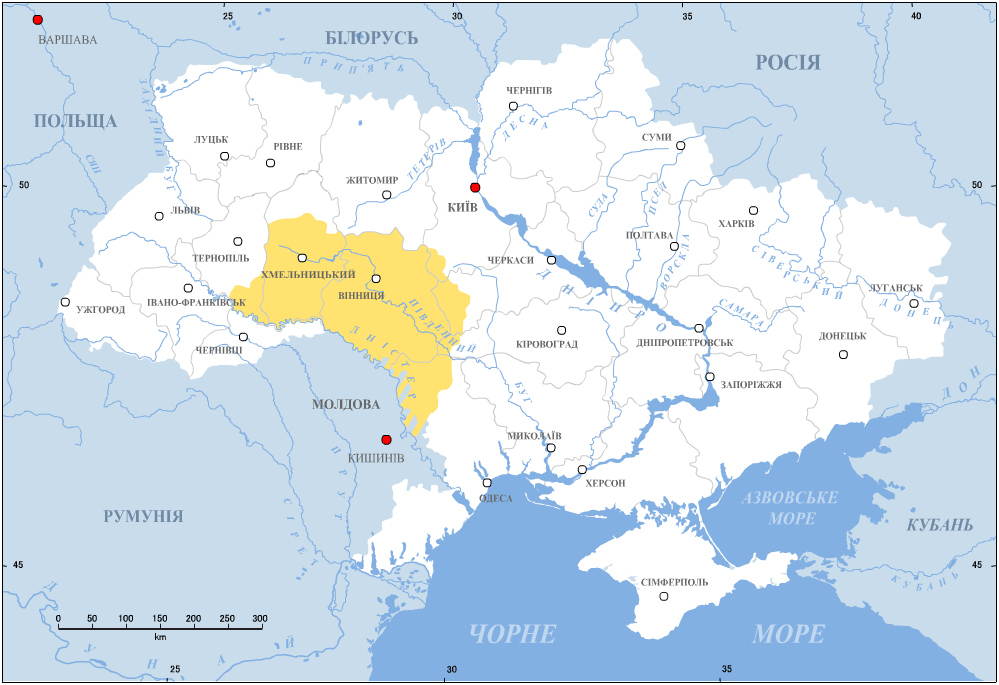

Why Africa is Crypto’s Next Frontier

Prof. Troy Cross talks about bitcoin mining in Africa.

March 11, 2024

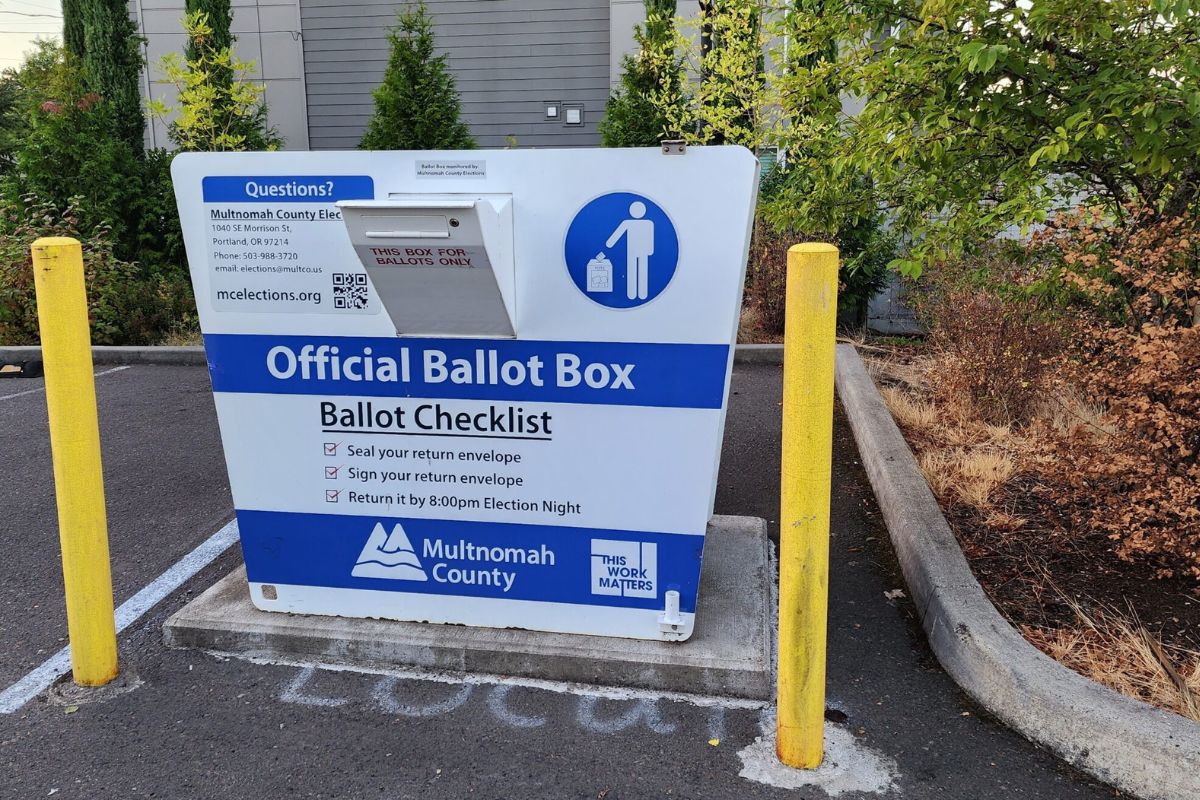

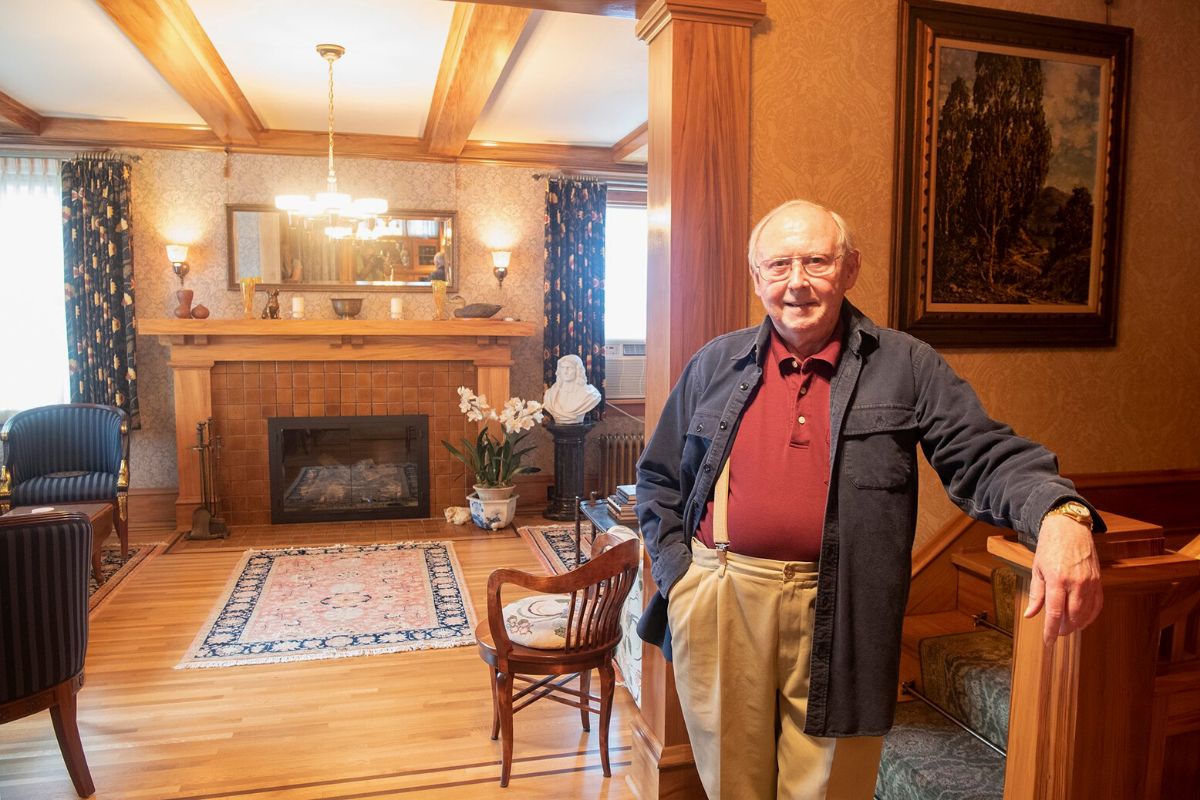

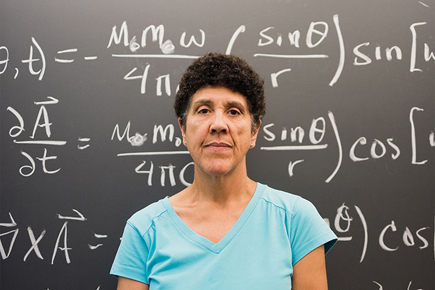

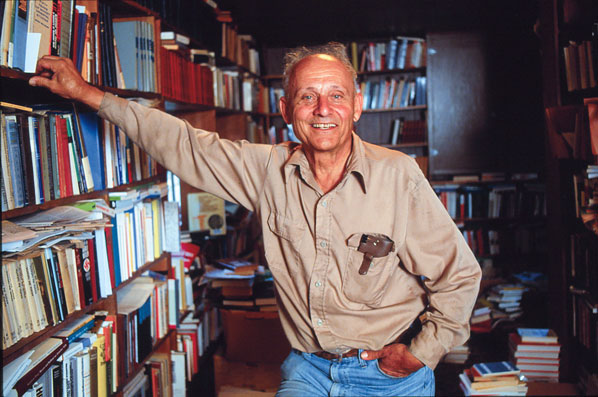

Teaching Staff Exchange Between the UB and Reed College

Professors from Reed College and the University of Barcelona will participate in a teaching exchange program.

March 11, 2024

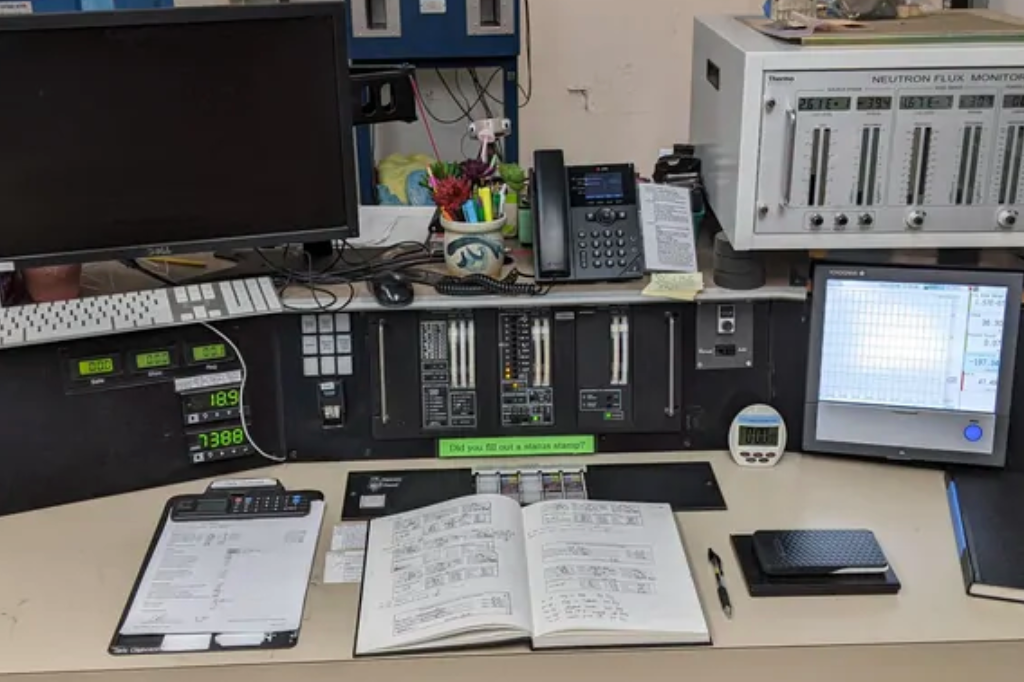

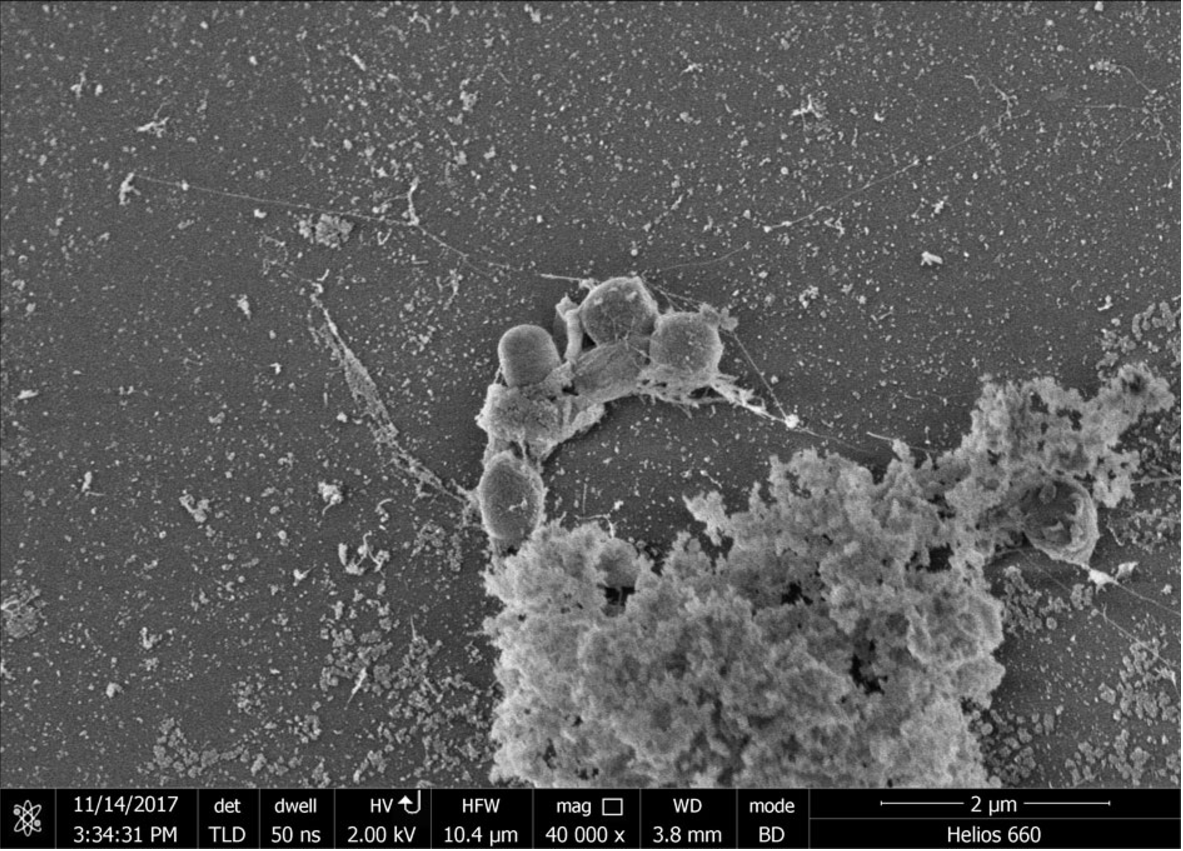

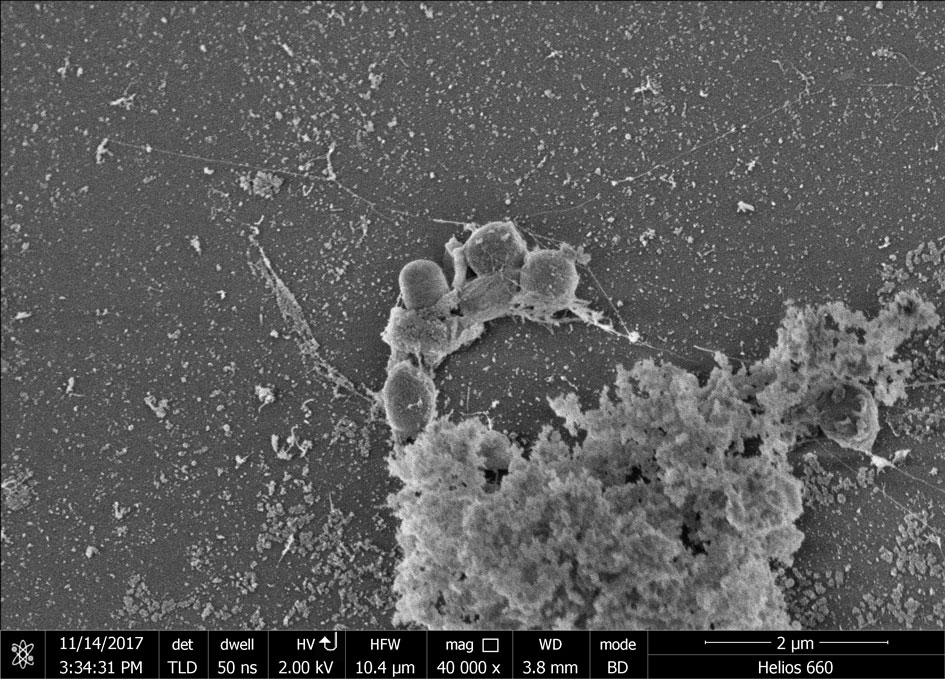

Dead Reckoning

Associate professor of biology, Samuel Fey, and colleagues research the ecolological aftermath of large predator die-offs.

March 8, 2024